From zero to IPO in 9 years - How Amplitude became a $4 billion company.

Reverse engineering lessons from Amplitude's journey from zero to IPO in 9 years.

Friends,

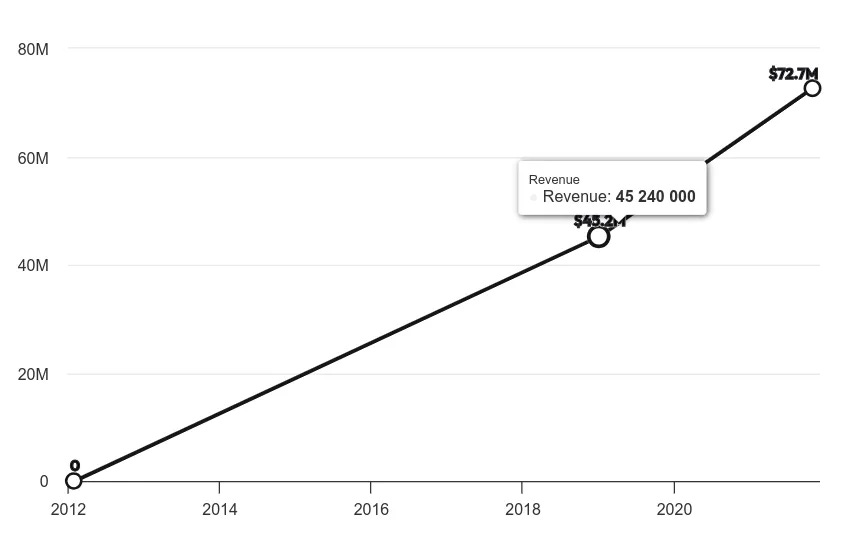

Amplitude is a $4 billion B2B product analytics SaaS.

Since its launch in 2012, it has reached 32000 customers & has generated $273 million in revenue in 2023.

It went public in 2021.

Here is how Amplitude went from zero to IPO in 11 years.

Brought to you by:

Market Curve turns tech companies into media companies by telling compelling stories via key distribution channels. Think of it like media as a service.

We specialize in B2B SaaS and have worked with folks from YC, 20VC creating newsletters, case-studies, websites, blogs, thought leadership content & much more.

Submit as many requests as you want for a fixed monthly fee and get your assets delivered in 3-4 business days. Pause or cancel anytime.

Wanna explore what this looks like for your business?

Getting into YC and pivot to Amplitude

Amplitude was built as a scratch your own itch kind of product. The founder, Spenser Skates was working on a product called Sonalight which got him into YCombinator in 2012.

On demo day, Sonalight was revealed - a text-by-voice software where users could talk and the device would let users text without touching a phone.

It went viral on demo day and got featured in TechCrunch & many other prominent publications. They got over 50,000 users for Sonalight.

The trouble they found was that of retention. Sonalight had poor user retention. Spenser had built an internal tool to look at the mobile user analytics (which would later become Amplitude).

Noticing that Sonalight could not sustainably overcome the retention problem, he dropped Sonalight and moved on to build Amplitude.

Getting Amplitude from zero to one.

Spenser moved in with his co-founder Curtis into his SF apartment. Learning from their mistakes, they did one thing very different with Amplitude.

They decided to speak to 30 prospective customers before building. And they consciously made the choice to spend 50% of their time talking to customers and 50% of their time building.

Their early motion was super simple. Talk to customers, give it away for free, get feedback, build requested features, talk to customers and rinse and repeat.

A few months into doing this, Spenser gave a demo of Amplitude to the CEO of a gaming company - Brett at Super Lucky. And for the first time, a customer asked Spenser how much it cost.

Spenser wanted to say something like $50 a month. And then he remembered Patrick McKenzie's advice to charge more than you're comfortable with so he blurted out $1000 a month.

And the buyer said yes. That was the first time Amplitude made money.

Hitting $1 million ARR in 9 months.

Since then, they kept doing more of what was working and Spenser transitioned fully into the sales role.

Amplitude took a completely sales-led approach to growth and reached $1 million ARR in the next 9 months.

They began reaching out to folks who have product analytics as a problem and just sent them an email saying, hey are you having any of these issues wrt product analytics, if so we'd love to talk more.

On these sales calls, Spencer was often asked how Amplitude works and customers would often say that “Hey we are gonna buy this if it has XYZ features”.

And so Amplitude went and built that. Their mantra was to out-build the competition which at the time was Mixpanel.

And by doing this they built a much more robust solution that catered to their customer.

On sales calls, Spenser would just keep doubling the the amount he would ask for in every subsequent sales conversation and people kept saying yes.

Amplitude's growth strategy

Soon after hitting the 1 million ARR mark, Amplitude added a product-led-growth lever to its acquisition strategy.

In the bottom-up PLG motion, users would self-serve and check out by themselves. On the sales-led growth lever, the sales team would talk to customers and onboard them manually.

For its PLG motion, Amplitude identified the difference between the user and buyer. The end-user was the product manager while the buyer was a manager or executive.

The user journey for the PM as the user was optimized. The TTV (time to value) was reduced drastically via interactive walk-throughs and demo using dummy data to give users a feel for Amplitude.

If needed, the sales reps got on call with the buyer to close the deal.

The activation step was defined as finishing the demo and connecting a data source to Amplitude.

This step was created after observing patterns with prior customers and what journey the average successful Amplitude customer took.

The next move was to make a free tier to acquire users at SMBs and give them the value they needed to acquire without paying anything.

Their pricing was value-based. Which meant that users would buy and move up the pricing tier depending on the value they received from the tier below.

For Amplitude, this meant users could track events and fix their retention (these were limited in the free tier).

Once they saw retention metrics improve, they moved up a tier since they were incentivized to pay for Amplitude. ´

It was during this time they also began to see interest from enterprises to use Amplitude. They decided to move upmarket and become an enterprise-serving company.

They also focused on inbound marketing & community building from scratch. Their growth handbooks on retention, acquisition & PLG gets tons of inbound leads. They also host webinars and events and positioning themselves as experts in their niche.

Amplitude also has a marketplace where they are matching companies with experts.

This is similar to the Webflow marketplace. And it seems like a growing trend to build a marketplace on top of the main software product.

To educate more users, Amplitude has also released the Amplitude Academy - this helps them acquire the end users (not the buyers) and train them on how to get the most value out of Amplitude which they can vouch for in their organization.

9 Key Lessons from Amplitude:

Talk to customers. Not doing this will be a huge mistake.

Spend 50% of your time talking to customers.

Recognize when something won't be successful, dont grind it out, cut your losses and move on.

Build & sell. That is all you need in the early days.

Your job is not to define the solution but to define the right problem. You will never completely know what problem you are solving so you always have to be invested in that problem and continuously get clarity each day.

No analytics or anything is needed until the first 500 users. Once you cross few thousand users, then you can start using analytics.

The standard baseline for identifying product usefulness is that after the first day, after using it for a day, 40% of your new users should come back the next day & then 10% of those should still be around by day 7.

Idea validation = can you get 5-10 people to pay you to try out the product?

Understand the difference between the buyer and user. Optimize the product UX for the user. Optimize sales processes for the buyer.

Whenever you are ready

Here are few ways in which I can help you:

Media as a service - Create a brand around your company via powerful content across different mediums. Available on a subscription. Pause or cancel anytime. Book a call to learn more.

Roast your SaaS landing page, onboarding & product UX - Enter your SaaS URL. And in 48 hours, get a personalized, custom-made video along with recommendations on how to optimize your SaaS onboarding flow in your inbox.(Book your roast now)

Revamp your SaaS landing page - Create a crystal-clear value proposition & positioning statement for your SaaS and communicate them clearly on your landing page. (Revamp your landing page now)

This is it for this long essay.

Phew! I am exhausted.

If you liked this essay, consider sharing this with a friend or share it on Twitter.