The Future of sales in an AI-native world.

The third sales wave & the fight to disrupt incumbents.

Hello all! Welcome to MarketCurve — been a while. Hope you are doing well & in good spirits. I got a bit of bad news over the last week — my friend from law school, his 24 year old younger brother passed away from a brain stroke. This really rattled me — this moment (this right now) is all we really have. I can collapse this very moment and that’s a frightening, humbling reminder of our insignificance as humans.

The only saving grace we have is to stay immortal through our actions — be it our work, helping others, taking care of our family. This way, even if our bodies die, our spirit will carry on.

Take a pause if possible & remind yourself that you’re right here & right now. And it’s such a privilege :) And take the time to enjoy whatever you’re pursuing, including this essay you’re about to read.

I have spent a lot of time writing this out —- it was very intellectually stimulating & fun to write. I hope you find it interesting as well.

Brought to you by:

Market Curve is a writing studio for tech companies & VCs.

Here is what I can help you with —

Website copywriting

Longform blogs, essays, newsletters

Onboarding, drip, and churn emails

Assets like decks, e-books, guides, case-studies

UX copywriting

Ghostwriting content for busy founders/execs

Have worked with folks from YCombinator, 20VC and more. Pricing starts at $1500/month.

The Future of sales in an AI-native world.

Hi friends 👋 ,

AI is eating the world. It has officially become a disruptor.

It's now an AI first world – AI has embedded itself into every existing software product & emerging products are rapidly integrating AI into their user experience.

Just like the Cloud led to the bundling & unbundling of software across industry verticals, so will AI. The Cloud got its first head start in the sales vertical with Salesforce kicking things off. So it makes karmic sense to study how AI will impact the sales vertical today.

The first sales wave, pre-Salesforce, was dominated by the Rolodex, spreadsheets, and client server-based apps. Selling was disconnected, clunky, and painful.

But in 1999, Salesforce introduced the software-as-a-service (SaaS) model. This moved applications & customer data to the cloud, giving rise to the second wave of sales — the digital acceleration wave.

This second wave started by software bundling. Sales software brought together data from siloed business centers & created a single source of truth for sales people to access. Relational databases meant every contact & data was stored in a database in a text-based format. Salesforce became an incumbent & the most valuable sales-company overnight.

Disruptors soon followed suit. Hubspot, Pipedrive, and countless other CRMs opened up to eat away at the Salesforce monopoly. Some like Hubspot expanded outward from their initial product, while others like Outreach sliced apart Salesforce & disrupted Salesforce in a more traditional way.

But now we are entering the third wave of sales - AI powered sales. AI-powered sales-applications will become the new cloud-based sales applications.

If there's anything AI is (at least for now), it's democratizing access to assets at scale. What this means is, AI will fundamentally alter how new products in the third wave are brought to market.

Historically, disruptors have won by slicing away a chunk of the market & innovating faster than the incumbents.

But with AI, incumbents themselves can innovate faster (relative to their past) so the disruptor can win by offering a better user-experience or solve a niche problem that the incumbent cannot solve. On the other side of the spectrum, disruptors can win by creating compound products, which AI can help leverage. And that is where the disruptors will win in this new sales-led-AI age.

Just as relational databases and cloud technology disrupted sales processes in the past, AI is set to redefine them once again. This time, it’s not just about organizing data or making it accessible—it’s about leveraging intelligence at scale. AI has the potential to do what the cloud did but with far more precision – automate tasks, predict outcomes, and personalize interactions at a level we’ve never seen before.

The future of sales lies in bundling. Companies need to pull off what Salesforce did in the 1990s -- bring data across these different verticals and put them in one place.

So how can sales-tech startups win in this AI age? What does their product need to look like? How can they capture a large market share etc & disrupt the incumbents?

In this essay, I'll attempt to answer some of these questions & hopefully offer some perspective. I hope you'll find this useful.

The pie keeps getting bigger

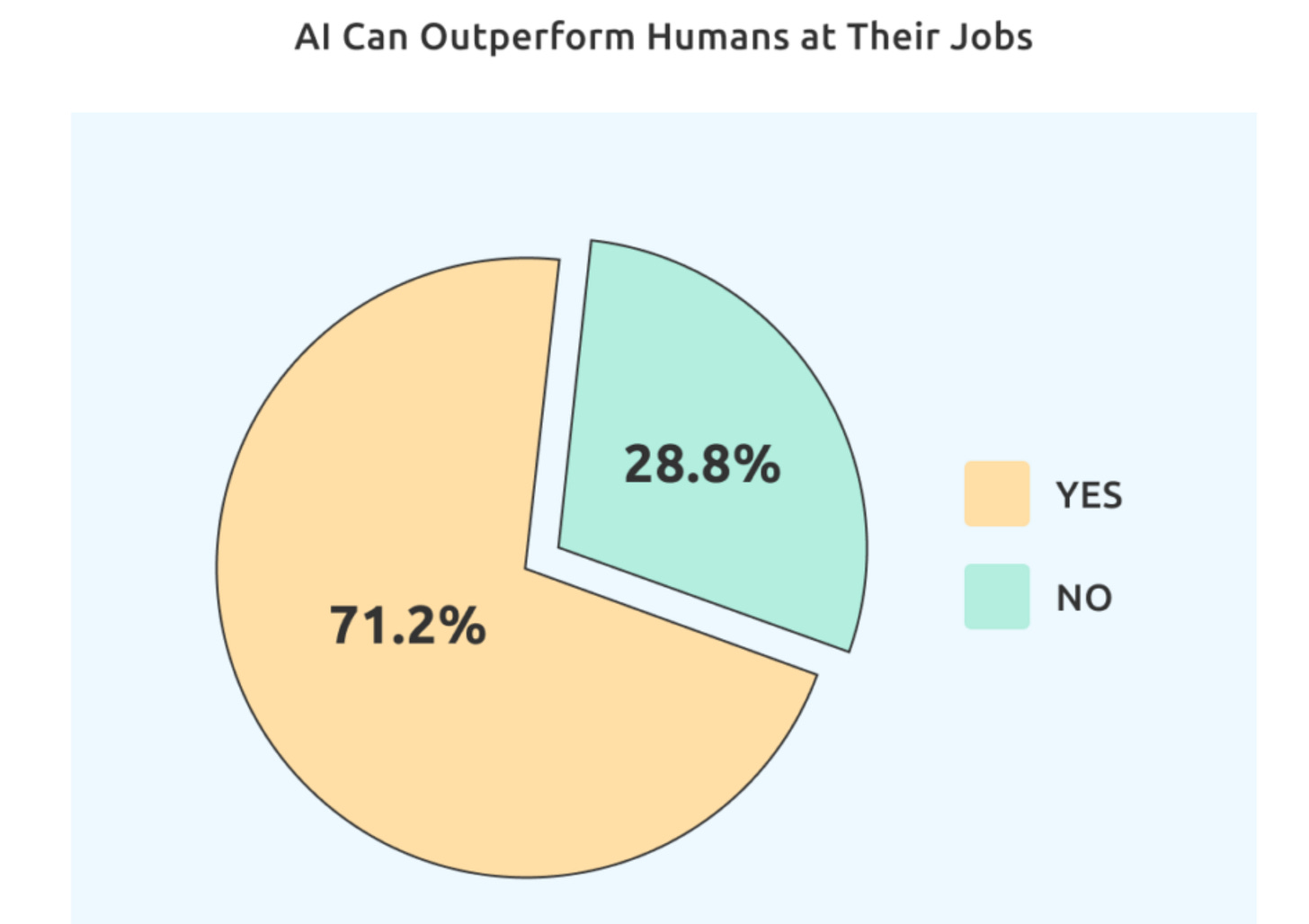

Despite AI’s popularity, there are plenty of naysayers. Some are downright apocalyptic, while others are slightly more articulate. An example of the latter is the line of thought where people believe that AI will create deflationary market forces, drive down costs & shrink the overall market.

The argument goes like this – As AI automates tasks traditionally done by human services, demand for those services will decline, leading to reduced spending, spelling bad news for the economy.

But this assumption misses a crucial point – the transition from services to software doesn’t just cut costs—it shifts value. Tasks that once required manual effort are now being automated or augmented by AI, making these solutions even MORE important to businesses.

As a result, we’re witnessing a rotation from services to software (more on this below) With AI enhancing or outright taking over many of these functions, the market size will expand, not contract.

As far as sales processes go, businesses would spend heavily on human capital to perform repetitive sales activities, like prospecting, writing email templates, analyzing lost deal flows in the domain of sales. But these activities can now be handled by AI more efficiently and at scale.

But this shift doesn’t mean companies are spending less, they’re just reallocating that spend. The dollars that were once directed toward services are now flowing into AI solutions, expanding the total addressable market.

This creates two critical outcomes:

Expanding Software Usage: As AI automates manual operations, the reliance on AI-powered software will only grow. This will cause more businesses to invest in software, expanding the market.

New Software Products and Revenue Streams: AI will create entirely new categories of software. From predictive analytics tools to hyper-personalized customer engagement platforms, the market will mature significantly. This opens up new opportunities that didn’t exist before, expanding the pie.

Back during Mulesoft’s IPO filing, the company highlighted a key ratio: for every dollar spent on integration software, businesses were spending an additional $5 to $7 on related services. Now imagine even a small portion of that service being redirected into software as AI takes over more of the workload. The potential for growth is staggering.

AI-enabled hyperbundling is the future of horizontal sales

The unbundling of Salesforce and HubSpot paved the way for specialized point solutions. For example, solutions like Clearbit emerged which could identify and reach out to website visitors, or hyper-personalization email software like Reply came up to automate outbound campaigns. But these tools, while powerful, stay in silos, creating fragmented data that doesn’t translate across the entire sales journey.

A website personalization tool may boost conversions at the awareness stage, but there’s no clear line connecting that touchpoint to the ultimate close rate. Sales teams are left with fragmented insights, guessing whether the tactics used at the start of the funnel are truly influencing deal outcomes.

The heart of this issue is that existing sales platforms are largely systems of record—essentially advanced databases that organize and store text-based information. Salesforce and HubSpot have built their empires by being the go-to repositories for contact management, deal tracking, and activity logging.

But in a world where buyers are engaging with brands through multiple channels—email, voice, video, social media—these platforms struggle to capture and integrate those diverse interactions. The future of sales requires moving beyond a text-centric database to something much more dynamic.

Imagine a sales platform where the core isn’t just text, but a multi-modal hub containing every customer insight in a single, unified space. This platform wouldn’t just track notes and email chains—it would integrate text, images, voice, video, and even non-verbal cues, offering a complete picture of every interaction a customer has had with your company.

This is where AI can fundamentally reshape sales. AI-powered tools could seamlessly aggregate and analyze all of these data types, drawing actionable insights that would have otherwise been buried in disconnected systems.

The next evolution in sales will rebundle these fragmented tools, creating integrated platforms where sales, marketing, and customer success operate from a single, intelligent source of truth. We’ll see the emergence of platforms that not only bundle these functions but enhance them with real-time, multi-modal intelligence. The key is building platforms that connect every touchpoint—whether it’s an email, a call, a video demo, or a social media interaction—into a cohesive narrative that informs how to close deals faster and more effectively.

A prime example of how this transformation is playing out comes from outside the sales industry: Rippling.

Rippling is to HR what Salesforce is to sales. Just as Salesforce uses customer data as the core foundation for its horizontal SaaS product, Rippling uses employee data as the source of truth for its comprehensive HR platform. Rippling has set out to be the operating system for the entire HR vertical, integrating everything from payroll to IT management into one cohesive ecosystem.

Historically, HR data and tasks were spread across numerous disconnected tools, each solving a specific pain point but creating administrative inefficiencies in the process. Rippling’s genius lies in rebundling these fragmented workflows into a single, compound product that offers a seamless experience across the entire HR spectrum.

Sales processes are massively fragmented:

This creates an opportunity to hyperbundle these functions into a cohesive, intelligent platform — with AI being present from first touch to final close.

This hyperbundling approach offers clear advantages:

Building an Ecosystem: A multi-product platform builds an interconnected ecosystem around the brand, with each part of the platform enhancing the others.

Single Source of Truth: With all products tied to a central data hub—the platform operates more efficiently. Common capabilities only need to be developed once and can be applied across multiple products, driving down costs while increasing functionality.

Superior User Experience: Once users are familiar with the UX, the entire ecosystem opens up, increasing customer stickiness and reducing churn. High switching costs become a natural moat.

Pricing Power: By providing a fully integrated suite, companies can optimize its overall bundle pricing, offering more value than a collection of individual point solutions could.

New horizontal products will win by embedding AI across the stack, layering it on top to provide predictive insights, real-time optimizations, and personalized recommendations.

However, this shift toward compound AI-driven platforms will not happen without competition. Horizontal AI applications will face intense rivalry and consolidation as the market works to identify which platforms offer the most value across the sales journey.

This rebundling will give rise to the next wave of SaaS companies - SaaS 2.0, which is Service as a Software.

SaaS 2.0 — Service as a Software

Historically, software has been built around providing tools—systems that help users perform tasks more efficiently. Whether it’s managing leads, sending emails, or analyzing data, software has historically been a set of tools that people use to get their jobs done.

But AI will reverse the existing model & create a new model in its place – Service-as-Software.

In this model, software doesn’t just provide the tools for a job – it performs the job itself. AI can now perform tasks that were strictly the domain of human service providers, blurring the lines between software and services.

Instead of just providing a CRM platform for sales teams to manage leads, imagine a system that autonomously prospects, engages leads, qualifies them, and even negotiates deals. Instead of just offering a customer support platform, think of a tool that acts as a 24/7 virtual support agent, capable of handling customer inquiries with the sophistication and empathy of a human.

The modern sales process is a multi-step journey that involves distinct roles across the sales team. Typically, it begins with prospecting, followed by booking demo calls, sending over follow-up materials, addressing legal concerns, and finally sealing the deal.

These tasks are divided among specialized roles such as Business Development Representatives (BDRs), Sales Development Representatives (SDRs), Account Executives (AEs), and more.

Traditionally, these roles operate in silos, with each team member focusing on a specific part of the sales cycle.

AI agents can potentially execute these roles with more efficiency while interacting with software on its own and managing the entire deal flow from start to finish.

Imagine an AI agent that starts with prospecting—identifying leads based on real-time signals from multiple channels—and then seamlessly transitions into booking demo calls, sending tailored follow-up emails, managing legal documents, and even negotiating contracts.

Each of these tasks, traditionally handled by different members of the sales team, can now be automated and optimized using AI.

The real game-changer lies in the development of multi-step AI agents—tools designed to handle not just one task but a series of interconnected activities. These agents can learn from previous interactions, adapt to changing circumstances, and execute complex workflows autonomously.

For example, an AI agent might start by identifying and prioritizing high-value leads, then automatically reach out via personalized email sequences, schedule a meeting, and follow up with relevant materials. As the deal progresses, the same agent could generate a proposal, manage contract negotiations, and even handle payment processing.

Take it a step further and AI agents can perform roles that are native to customer success & marketing. This will create a massive hyperbundling fusion with sales, marketing & customer success merging into one.

This approach is applicable to both horizontal and vertical sales solutions. Horizontal platforms can leverage AI agents to deliver broad, scalable solutions that cater to multiple industries, while vertical platforms can fine-tune their agents to the specific needs and nuances of their niche markets.

As AI agents become more capable, companies can bundle these features into a single platform, offering a unified solution that spans the entire sales journey. These agents will work autonomously, gathering insights from every interaction and optimizing their strategies in real time.

Rather than selling access to tools, companies will be selling access to automated services that deliver specific business outcomes.

This model is particularly useful for vertical SaaS solutions, where specialized knowledge and workflows can be fully captured and automated by AI, providing a more precise and tailored service than generalized horizontal platforms.

How can vertical first SaaS companies win?

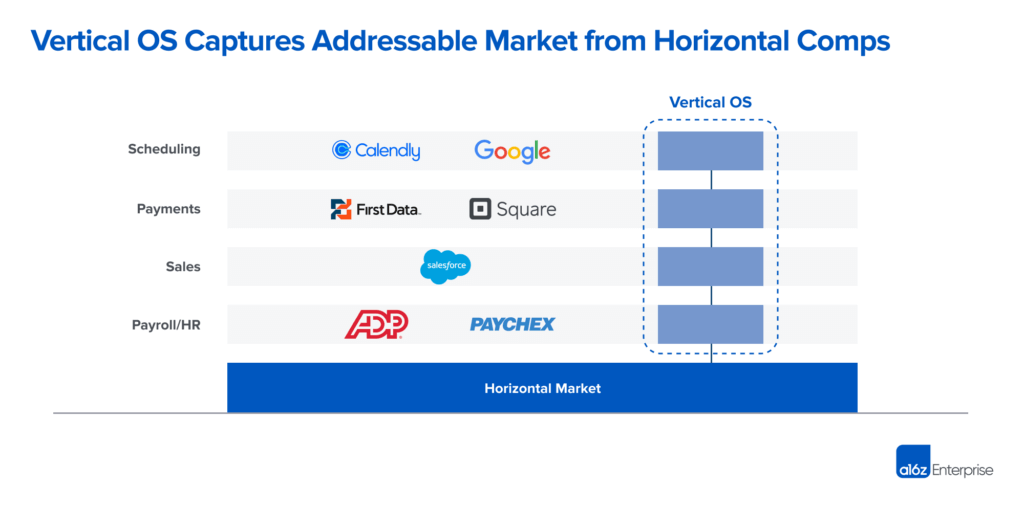

While bundling is a powerful strategy, there’s another path that’s equally compelling in the AI-driven sales-tech landscape: focusing on unbundling to create a specialized vertical solution in a particular industry.

Unlike horizontal platforms that aim to cover a broad range of industries and use cases, vertical SaaS products narrow in on a specific industry or workflow, refining and perfecting their offering within that niche.

Vertical SaaS companies benefit from having more focused and accurate data, allowing AI models to be fine-tuned to the exact needs of the industry. By focusing on one segment, it can leverage AI to personalize customer experiences, predict demand trends, and automate industry-specific workflows with greater precision than horizontal competitors.

Even niche verticals can represent massive opportunities. For example, in the sales-tech space, companies like Clio (for legal professionals) and ServiceTitan (for home services) have capitalized on the deep needs of their respective industries.

Though these niches seem narrow, they are substantial enough to support large, high-growth businesses, making it easier to justify early-stage investments. Vertical products win because of:

Higher Margins and Retention: By focusing on a specialized vertical, companies can achieve higher profit margins and stronger customer retention. Customers find it difficult to switch because the software addresses their unique pain points more effectively than generic solutions.

Lower CAC and Faster Growth: Vertical SaaS companies can fine-tune their GTM strategy, reducing customer acquisition costs (CAC) and scaling rapidly within their chosen niche. The targeted approach also allows for more refined messaging, increasing conversion rates.

Unique Data Advantage: Specialized verticals inherently generate more relevant and high-quality data, which further enhances the AI’s effectiveness. With cleaner, domain-specific data, vertical SaaS companies can train better models, leading to more accurate predictions and insights. This creates a feedback loop where the more a company refines its niche, the better its AI becomes, and the more value it delivers to customers.

Better Product-Market Fit and Domain Expertise: Vertical SaaS solutions are built on deep domain expertise, making them more relevant to the specific needs of their target audience. With fewer competitors and less noise in a focused market, vertical SaaS companies can gain traction faster, often leading to a “winner-takes-all” scenario.

Differentiation through UX and Ease of Use: In vertical SaaS, UX and ease of use become critical differentiators. Since these solutions are designed with specific workflows in mind, they can offer a streamlined and intuitive experience that generic, horizontal products cannot match.

The future of sales-tech will see more vertical AI apps where companies focus on niche markets with specialized needs.

In these spaces, AI can leverage highly accurate and personalized data, leading to better results. Vertical SaaS companies don’t face the same level of competition from incumbents as horizontal solutions, giving them an edge in gaining market share.

AI has reached the point where it’s no longer just an enhancement—it’s the engine driving the next wave of sales transformation. Just as the Cloud revolutionized the software industry, AI is redefining what’s possible in sales by enabling smarter, faster, and more integrated processes.

Whether through the rebundling of tools into cohesive compound platforms, vertical SaaS solutions that target specific niches, or the rise of Service-as-Software models, AI is reshaping the sales landscape in profound ways.

The future of sales lies in solutions that leverage AI to provide not just tools but outcomes—automating tasks, predicting results, and optimizing every step of the deal flow.

As AI agents become more sophisticated, they’ll integrate seamlessly across workflows, turning traditionally fragmented sales tasks into a unified process. This blurring of lines between software and services marks the emergence of SaaS 2.0, where software does more than assist—it autonomously drives results.

The companies that will win in this AI-first world will be those that understand how to balance bundling and specialization, integrate AI deeply across their platforms, and align their success with customer outcomes.

We’re entering a new sales-led AI age where innovation, customer experience, and intelligent automation will determine who leads and who gets left behind.

In this landscape, disruptors have a unique opportunity to outpace incumbents by focusing on niche problems, creating compound products, or leveraging AI to deliver unprecedented value.

As AI becomes the new foundation for sales, those who adapt and harness its potential will be the ones defining the future of the industry. The AI-first era is here, and the winners will be those who move fast, integrate deeply, and, above all, stay laser-focused on delivering real value to their customers.

How did you like this week’s edition? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad

Thanks for reading & see you on Monday.