The concept of bargaining power is closely tied to that of leverage. Leverage is just the application of a lever - a tool that is able to lift something much heavier than itself.

The length of the lever is proportional to the weight that it can lift. Therefore, the greater the length, the heavier the weight it can lift.

In a market, customers, in a lot of cases, use pretty powerful levers to dominate market forces. This use of levers creates disproportionate benefits for the customer often at the expense of the business.

Let’s dive in and see how.

I’m Shounak - founder of Market Curve, a humble startup that helps SaaS companies communicate their value proposition persuasively across their website.

When I first started my company 2 years back, I was deeply inspired by Paul’s work and so I think it’s only fitting that I share my thoughts on his now-pretty-famous quote.

Wait…but does this REALLY happen?

More often than you think. There are many business models that enable customers to enjoy disproportionate benefits. Marketplaces are a good example.

Take Fiverr for example - a marketplace where freelancers share their work and are approached by customers who are looking for a solution that the freelancer offers.

Now, lets say the freelancer offers a logo-design service. I the customer, would go on to the platform and type in “logo design services” and I’ll get at least 50-100 freelancers ready to hire at any given moment.

Let's also assume for the sake of simplicity that there are just 10 businesses that would need logo design services at any point in time - me being one of them.

Now, this is where things get interesting. If I enter the transaction knowing that there are 100 freelancers and just 10 of me at any given time, I am operating in a “scarce” space. By that I mean, there is more on the supplier side and less on the buyer side

This means that my choices are abundant and I can pick and choose which freelancer to go with based on my requirements. While the freelancer does not have this freedom. Since there are 100 competitors lying around, he is more likely to say yes to any offer that comes his way.

Because I’m in scarce quantity (relative to the suppliers), I’m also by default valued more - a classic economic theorem of scarcity driving demand.

Because of this value I hold in the market, I get to call the shots. This leads to an imbalance in the market forces where the freelancers (or businesses) eventually might go extinct.

Let’s envision a few scenarios, shall we?

How easily can I switch teams cap’n?

Low switching costs on the customer side are a perfect breeding ground.

If the buyer is able to switch effortlessly from one service provider to another, the supplier is left with little to no leverage to bargain a fair deal for itself. This ties into the concept of building moats for your business

For example, network effects are a good example of moats. Facebook and Instagram are great examples of this. They use the social network effects so high that it doesn't even cross peoples minds to switch to something else.

Building some degree of complexity into the platform is another. Bubble, Hubspot, Salesforce do this very well.

If you invest some amount of time getting familiarized and acquainted with a platform, there’s a high switching cost involved since you’ve fallen prey to the sunk cost bias. Where you perceive that the cost of switching is so high you’re better off just getting better at the platform you’ve already invested some amount of time in.

The One or The Many?

If the buyer is able to merge different services and products together to create a “stack” for himself, he has a higher bargaining power

For example, when building a website, I could use Carrd to build a landing page. I could use Memberstack to set up member logins. I could use ConvertKit to set up a newsletter. I could set up Stripe to collect payments. And create a nice stack for myself.

In this setup, the entire value that is created is fragmented across these different verticals and each business takes a piece of the pie.

Alternatively, I could just use Squarespace where I can build my landing page, collect member logins, set up a newsletter and collect payments for my products, all from one platform.

In the second scenario, Squarespace would own the entire pie because it’s owning the entire value-chain from start to finish. And because it does that, it's very unlikely that customers would switch over after (s)he’s invested in this software. Here the customer’s bargaining power is low. And that of the business is high.

Wait you’re a mom-and-pop shop too?

If the buyer is able to get similar products and services from other suppliers, he enjoys greater bargaining power.

For example, even a market as niche as privacy-focused analytics market works in this scenario. This is because every offering makes the same claim.

There’s Fathom, Plausible, Simple Analytics , KindMetrics - the list goes on.

Because the product is undifferentiated and there are several like-for-like substitutions available, the customer enjoys all the bargaining power.

If, however, you position yourself in a way or have a feature that crosses a threshold of “like-for-like” substitution, you’re in business.

Because then you automatically enter the domain of a “category of one” - a classic blue ocean strategy opens up for you at this stage.

Don’t drop the ball Mike!

With all these advantages, customers can get businesses to provide higher quality products and better customer service.

The customer could use his clout and prompt businesses to provide higher quality products. They can simply make the argument that because your switching cost is low, I’ll just switch over and take my business elsewhere if you don't provide me a high quality product

This is a good sign because the business would value the customer, not take him for granted and go out of his way to create a high-quality product. This would then mean that the business would have to excel at providing excellent customer service and make sure that the customer is valued.

And with competitors breathing down his neck, he would also make sure that he provides an offering that is relatively better than those.

That said, there could be times when the customer could exploit this privilege of his and take advantage of the business.

Or there will be consequences…

Customers can also get businesses to offer more at the same price or lower their prices.

This borders slightly on the domain of exploitation. Because the buyer is aware of his bargaining power, he can command the buyer to do more at the same price as his competitors if he wants the deal

This might also be interpreted as the market having a gravitational pull and helping the business realize that within this market, at this price point, the value offering would need to be increased.

As a result, any supplier who adapts to this would gain an advantage over his competitors and possibly enter a market of his own. Creating a potential monopoly where he would get to call the shots.

As a result, the other businesses will be “forced” to lower its prices - again this can be good or bad depending on your status as a business.

If you’re funded, it probably is a good sign for you and you can leverage that information to target similar prospects and capture a greater share of the market at the expense of your competitors.

If you’re a bootstrapped business, the equation becomes different because then you would have to consider whether reducing prices in the short term would be sustainable in the long term.

What does all this mean?

A market where the buyers call the shots is tipped in favor of the buyer - there is inequality baked in right from the start. In a conventional (read non-funded) business, this imbalance would lead to the business eventually bowing out until only a few players remain.

Since the customer would either (a) try to get more value at the same price point or (b) lower the prices of the products, it would mean the business would have to compromise on the price.

Since his costs are more or less fixed, he would either have to (a) reduce his margins or (b) make a loss on his product.

Both of these are unsustainable in the long-term because of which the suppliers’ number would go down.

Now there will come an equilibrium where the number of buyers would be equal to the number of suppliers at which stage the buyers would lose their leverage.

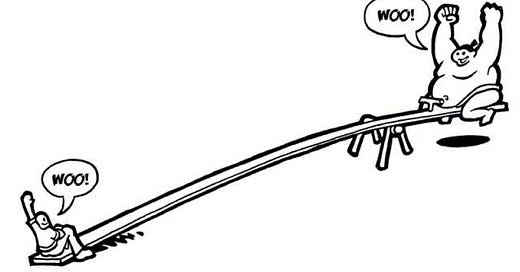

And beyond which, the bargaining power would shift back in favor of the seller. Just like a see-saw (See what I meant by levers?)

So then the solution becomes that if any business stays long enough in a game (even suffering losses) so that other players just drop off, this will create long-term benefits for the business, post the threshold cross that might potentially outweigh the losses suffered.

This slightly enters the territory of game theory which I won't get into here but as you begin to understand the market forces, you can begin to predict what will happen as a result of the nature of these forces.

I guess the lesson here is to understand the game you’re playing and how it ties into your market, your customers, your product, and the see-saw you guys are on.

And when you are aware you’re on the see-saw, you can just come back to this essay and remind yourself that it's just levers at the end of the day. Pull the right ones and you’ll get the right outputs.

Pull the right levers for your business

Speaking of pulling right levers, you know what’s a great lever for your business growth? Creating compelling content around your brand and what it stands for. You have a vision as a founder. Tell your story. In as compelling a narrative as possible. That’s what I’ve been working on these last few weeks (hence the radio silence on my end apologies).

I’m partnering up with a close friend of mine from law school and we’re building Spectral. A content studio that helps founders and investors communicate their vision using compelling language and design. That’s our vision.

We’re already working with cool companies across super cool industries - music and creator economy, web3 platforms, voice recognition, personal/professional productivity and much more.

So if you have your own cool ideas you wanna bring to life using word and design (or know someone who is) then we’d love to jam ideas! Just email me and we’ll take it up from there.

Shounak out.

If you liked this essay, consider sharing it with your friends.